Blogs

Don't let data risks spoil your M&A party

Written by Oliver Harvey

The global market for mergers and acquisitions reached new heights last year, and many expect the frenzy to continue in 2022. The latest annual survey from Pitchbook estimated there were 38,000 mergers and acquisition (M&A) transactions in 2021, with just shy of US$5 trillion in deal value.

That’s a lot of activity. But despite the lofty goals and growth projections that drive M&A decision-making, history shows these transactions don’t always convert into corporate value. In one study, for example, Deloitte analyzed 116 M&A deals that were explicitly “growth-oriented,” and found that only 27% helped those companies grow faster than their historical rate.

POST-DEAL INTEGRATION AND SYNERGIES

There are, of course, many reasons why companies fail to realize the cost or growth synergies anticipated for a deal; economic and political issues and “people” and cultural differences are often cited.

Some companies simply fail to manage the huge operational complexity of acquiring or selling a business. This can include failing to manage the risks inherent in the buyer’s or seller’s data. This is a significant issue when you consider that global data volumes double every three years or so and more than 80% of the world’s data is unstructured, such as emails, making it harder to manage and understand.

Challenges in managing corporate data can lead companies to struggle with issues such as:

- Identifying and retaining the company’s commercially sensitive information and intellectual property

- Identifying compliance risks in the target company’s data

- Locating key contracts for day-one operations and maintaining effective systems for managing issues like third-party risk.

These struggles can have dire consequences down the track. Highly-priced intellectual property may turn out to be kept haphazardly across multiple storage systems, making it hard to consolidate and extract value from. In the case of a divestiture, it may get left behind with the parent entity or inadvertently sent off with the buyer. The acquiring company can also inherit compliance risks – in the current environment, especially privacy risks – which lead to regulatory action or litigation when things blow up post-acquisition.

RETAINING VALUE, MINIMIZING RISKS

How can companies avoid leaving value on the table or acquiring unforeseen risks? Over many years of working with companies and their advisors on M&As, Nuix has developed a robust approach to understanding and addressing these data governance and risk issues.

In one example, Nuix worked with a global pharmaceutical company to avoid it sending off its critical intellectual property along with the subsidiary it was divesting. To achieve this, Nuix had to search the subsidiary’s data centers for the parent’s intellectual property. This meant finding IP across millions of emails, documents, and other unstructured records and then remediating the data, all under tight commercial deadlines.

OUR PROCESS

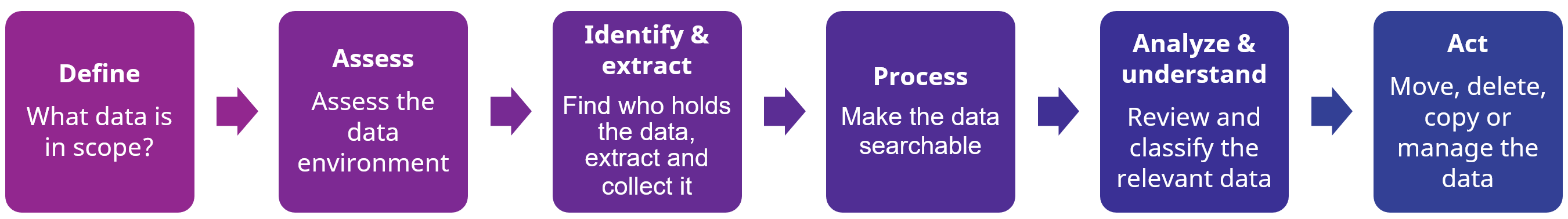

Our process, in broad strokes, is detailed in the diagram below.

The main advantages of using Nuix technology and workflows, for the buyer or selling company, include:

- We can find and collect data (such as critical intellectual property) from local and remote repositories, including laptops and desktops, email servers, file shares, and cloud sources

- Our efficient and scalable processing turns more than 1,000 file formats into meaningful and searchable information by capturing the content and metadata

- Our browser-based review software enables fast and efficient collaboration for merger teams to analyze, classify and report on findings

- Once you have classified data, you can defensibly move or delete it, copy it, or flag it for further action.

Just as importantly, in M&A transactions the parties need to review huge amounts of data under the shadow of commercial and regulatory deadlines. Most of our customers say that compared to competitors, Nuix has the fastest data processing, can review the widest variety of file types, and can handle the largest volume of data.

Equally exciting is that this workflow is not just a one-off exercise. Once you’ve gone through the trouble of setting it up, it can deliver ongoing value for the merged entity. The target company and its acquirer can scan for changes up to the merger deadline and proactively monitor to maintain compliance and deliver data and cost efficiencies afterward.